7 REITs are in my watch-list and am aiming to buy one of them

Happy New Year to all my readers!

It has been a very fruitful year for me. My reader base is growing nicely (thanks for all of your support!) and is excited about the up coming Personal Investment Seminar in January. In my New Year’s resolution, I will put “More regular update to blog” as one of my action item for 2015. Hope to continue to get your support.

7 Singapore REITs that made it to my watch list

For the readers that have read my earlier posts, they will know that I like to use % dividend Yield over Price/NAV ratio as my main filtering criteria for potential REITs counter to buy. Followed by other criteria like Debt to equity ratio etc. If you want to revisit, you can click here.

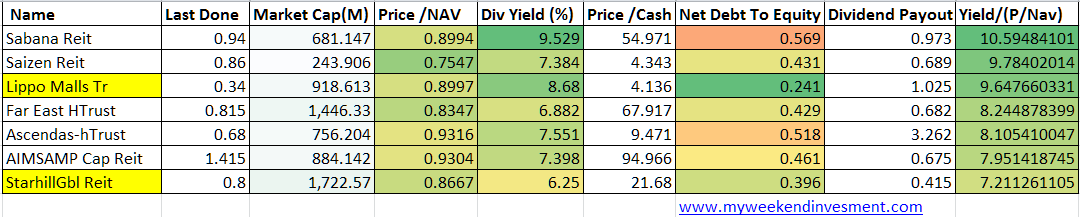

This time round, it is no exception. Here are the top 7 the made my cut:

Dark green represents favorable ratio. Light green or red represents less favorable ratio. Sitting at the top of the list is Sabana Reit and Saizen Reit. The ratio tells me that in a longer term these two shows the highest potential to deliver good value as they are currently giving good dividend yield with discounted asset. But I did not do any further investigation on these two as Sabana Reit have high Debt to Equity ratio and I am already committed to Siazen Reit.

But wait! Is the environment good for REIT investment now?

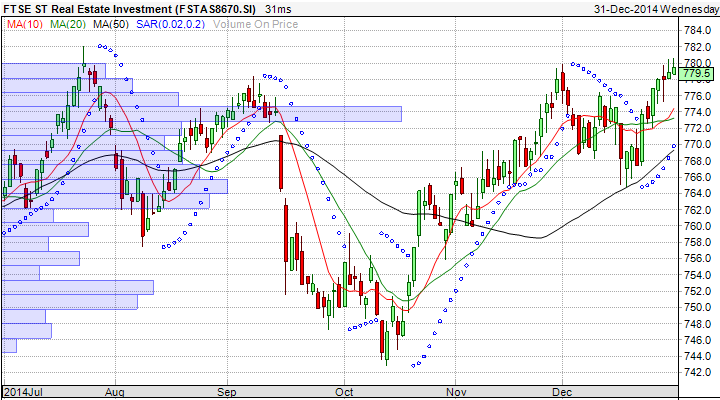

If you look at the STI REIT index, it is sitting on the high side. Which means, REITs prices are actually on the high side over the past 2 years. I reckon it is mainly due to the Fed announcement that interest rate is not going up anytime soon. Because any increase in rate will directly impact the bottom line of REIT business as they depend a lot on loan financing to run their businesses. The other factor in play is the sentiments of the investors. Mainly are optimistic that US is slowly but surely turning around. This is good news to local firms as US is our largest trading partner.

So should I invest in REIT now?

No harm looking is what I always say. You never know what you are going to find. One good example is Lippo Malls Indonesia Retail Trust (LMIR). If you look at their top line financial ratio, they are actually quite attractive. Especially the Price to NAV ratio of (0.89). Yield (8.68%) is not too shabby too. So I investigated more find out if this one is worth getting.

Lippo Malls Indonesia Retail Trust’s (LMIR) Fundamental

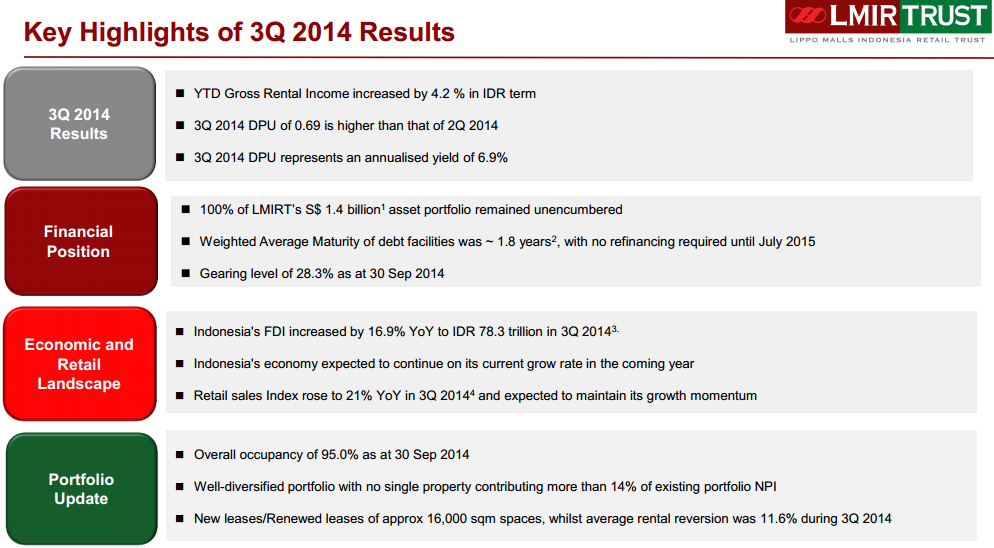

If we look at the last quarter report highlights, it looks pretty good. The key things I picked up:

- There is increase of retail income. Good sign of growth. You always want to invest in companies that can show growth.

- Higher DPU compared to last quarter. But if you look past 2 years, DPU is actually not increasing.

- All of their assets are unencumbered. This shows their strength in getting loans. They are after all one of the biggest developer in Indonesia.

- WAMD is 1.8 years. So no need to find a new loan till July 15.

- Very low gearing of 28.3%. This is because they are holding cash to buy a new retail mall.

- The new Mall ( Lippo Mall Kemang (“LMK”)) will cost S$385M or about 2.7% discount. You can get more information from here.

- This is a big acquisition for LMIR because this single mall can increase NPI by 25% and

- Increase DPU by 7%

What they didn’t highlight to you

- Their DPU is not very consistent. You can see from the historical DPU payout chart below.

- To fund the new mall, they recently announced a private placement of 117M shares at $0.34 to institutional buyers. This is not very good news for existing shareholders who are not given any chance to participant and have to suffer the dilution. This I would say is the biggest bugbear for any retail investors.

- They are also issued (18th Dec) 118M Consideration Units to Bridgewater International Limited (their property manager) at $0.38. See here for details. This is also bad news for existing shareholders as it dilutes the value even more. Meaning existing shareholders will be forced to share the returns with new shareholders who are offered a discounted share price.

- So, how much did the new shares dilute shareholding? Well, the new shares represents a 12.2% of existing total shares. Assume the fair trading price of the counter is $0.40 (before the new issue), the share price will be diluted to ($0.37 X 87.8%)+($0.34X6.1%)+($0.38X6.1%)=$0.368

LMIR Technical

If you look at the 1 year chart, you will notice significant drop in price around Sep time-frame and in the early Dec time. The decline in price coincides with the first announcement of the acquisition of the new Mall and the need to issue new shares to fund the purchase of the Mall. There is significant selling on 16th of Dec right after the announcement of them getting approval to list close to 300M new shares to fund the new mall. The lowest it got was $0.305.

From a longer term perspective, Lippo Mall Reit does not have a very good track record. They lost almost 38% of their value over 2 years. This is not surprising as their dividend payout are not consistent at all. The main reason why investors like REIT is because of the high and regular dividend yield. If a company fails to deliver that, their price value will suffer.

Another big factor weighting on the price is the falling Indonesian Rupiah. Unlike First REIT, they do not collect rent in Singapore dollar. So the Rupiah weakens, you would expect the SGD dividend payout to be lower.

So can consider to invest now?

I personally think that this present itself as an “opportunity” buy. Normally, I will not touch this counter, but because of the recent announcement and corporate actions, I do see a window to enter and take advantage of the “over selling”. Anything below the price of $0.36 ok from the fundamental point of view.

But I would not hold on it to for very long term unless the REIT management can show with the brand new purchase stabilized and improve the NPI. Way to do this is to improve the occupancy rate (they have a few properties that have low occupancy rate) and value add to improve rentals.

What do you think?

Disclaimers: this is not a recommendation to buy or sell anything. All the discussion above are based on my personal opinion.

[…] By roland […]

LIPPO is in my watch list too but I will go in only if it hits $0.33 or lower

I have done a quick and short CNAV analysis on LIPPO recently too : http://www.investopenly.com/2014/12/lippo-mall-indonesia-retail-trust-my.html

😉

HI Richard,

I have been monitoring this counter and looks like $0.34 is a strong support. did you manage to get in at $0.33?

Hi. They collect rent in rupiah currency. One of the main reason their dpu was not consistent is because of fluactuating sgd rupiah exchange. You might want to relook at the dpu or npi trend over the past years interm of rupiah.

Hi Boochap,

thanks! I will look into that!

I think LIPPO dividend is good but the share price will keep depreciate because of currency between rupiah and SGD

Hi stanic, I think the growth potential is greater than the currency risk. so I am still invested.