CPF changes from budget 2011 is good news right?

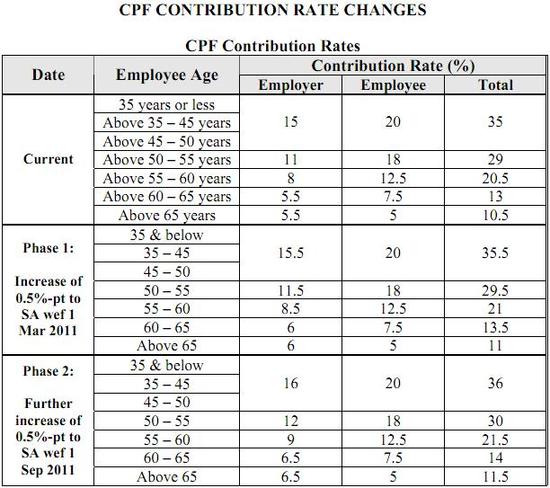

2 key changes to the CPF contribution took place in the recent 2011 budget announcement. Generally good news for employees and not so good news for employers (see table below for details). Here is are the changes:

2 key changes to the CPF contribution took place in the recent 2011 budget announcement. Generally good news for employees and not so good news for employers (see table below for details). Here is are the changes:

1) Increase contribution ceiling from $4500 to $5000

2) Increase contribution from employer from 15.5% to 16%

So in general good news? well.. lets see..

1) With the changes your employer will now need to pay ($5,000 X 16%) $800 to your SA account compared to $697.5 ($4500X15.5%). So you gain $102.5 assuming you reached the max contribution ceiling.

2) But with increase of contribution ceiling means you will also need to contribute more. You used to contribute ($4500X20%) $900, but now is ($5000X20%) $1000. Which mean you are $100 down on your disposable income (cash flow)!

So net net, your disposable income is down $100, but your CPF account gained by $202.5. Whether it is good news or not really depend on what you were doing with your excess cash. But one thing is for sure, we better look closer at our CPF accounts and how we can make our CPF money work harder for us. Any ideas on the best way to invest CPF monies?

I have created a separate page focusing on CFP and SRS to explore ways we can invest those monies. Still in building up, so ideas and contribution are very welcome!