My Stock assessment- Hyflux

This is a series of blog that talks about my stock selection assessment.

This week, I spotted Hyflux up trend and started to do a BUY assessment. Here is what I found out:

Big Picture

Fundamentals

-US economically data is showing some positive signs.

-EURO is showing some form of stabilization.

-There seems to be a strong flow of investment dollars from US to Asia.

-But the debt issue is still thereTechnical

-All major indices are moving up. US leading the way and Asia is catching up

Fundamentals

-US economically data is showing some positive signs.

-EURO is showing some form of stabilization.

-There seems to be a strong flow of investment dollars from US to Asia.

-But the debt issue is still thereTechnical

-All major indices are moving up. US leading the way and Asia is catching up

Individual stocks (Hyflux)

Fundamentals

-The NAV value is 1.0594

The Pice/NAV ratio is 1.3876 -Price/Cash Flow is 1.681

Technical indicators

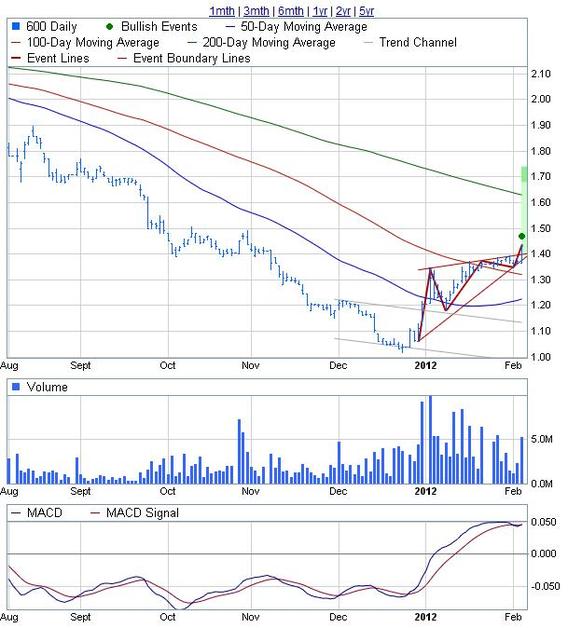

-A bullish indicator has Bullish “Bottom Triangle” formed with high volume.

-The price rose above 100MA but still a distance from 200MA.Overall, both the fundamental and technicals looks pretty good. My buy price is 1.44 and my cut loss price is 1.39.

Hope this stock flies! 🙂